Mar 16

Lender’s Mortgage Insurance can help you enter the market sooner.

Lender’s Mortgage Insurance (LMI) helps Australian homeowners enter the market earlier through allowing you to borrow a higher percentage of a property’s value.

For first home buyers, particularly those struggling to save a deposit but more than comfortable to meet their mortgage repayments, it can be a key tool to break free of the rental trap.

Through financing a higher proportion of a property’s purchase price lenders take on a higher level of risk that you will fail to meet mortgage repayments, and the property needs to be repossessed and resold.

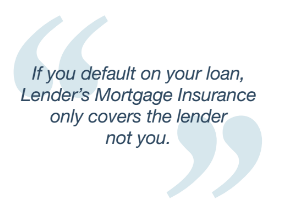

LMI is therefore paid by you to insure your lender against loss should this happen. It is important to be aware that LMI only covers the lender if you default, not you.

The bigger the percentage of the property’s purchase price you have to borrow, the greater the amount you’re likely to pay on insurance. So if your deposit is less than 20 per cent of the value of the property, and especially if you have no deposit at all, you will need to factor LMI into your home loan.

Remember that in some cases lenders may require LMI for lower LVR loans, depending on the type and style of property you’re purchasing – for example some inner-city apartments or rural land.

LMI is usually paid as a one-off lump sum at the time of settlement but in many cases it can also be added into the loan amount and paid off over the life of the loan – a term known as capitalising the LMI. Speak with your broker to assess whether this option is right for you.

Feb 16

Your step-by-step checklist for being home owner ready!

Arranging your finances

- Contact your mortgage broker and arrange an appointment

- Arrange supporting documents (i.e. pay slips, group certificates, credit card statements and other relevant documents)

- Assess lending capabilities with your broker, shortlist loan options and determine the most appropriate loan from the shortlist

- Submit loan application with all supporting documents

- Obtain pre-approval*

Note: Finance can be secured before or after you find a property. However borrowers should consider a pre-approval so that they have a true measure of their borrowing capacity before they commit to a purchase. *Pre-approvals are usually always subject to further conditions.

Buying your house

- Engage a solicitor or conveyancer to check sale contract

- Place offer for home/win at auction

- Complete building and pest inspections, strata and title searches

- Sign contracts along with submitting agreed deposit

- Arrange insurance (contents, building and/or income protection)

- Process first home owner grant (FHOG)

- Complete settlement

- Pick up keys

Moving in

- If currently renting, advise landlord that you’re moving

- Collect bond from rental agency

- Arrange disconnection of utilities and cleaning of old premises (if required)

- Arrange quotes from removalist companies/schedule moving times

- Connect the gas, electricity and other utilities

- Connect pay TV and internet

- Connect new phone line

- Redirect mail (can be arranged through your local post office)

- Redirect newspaper delivery

- Advise family and friends of new address/phone details

- Clean up home before you move in

- Move the family in!

Finding and applying for a home loan can be a tedious process. As professional loan experts, we’ll be able to help you find a suitable product which will suit your financial needs, guide you through the process, and manage your application from start to finish. Give us a call today.

Jan 16

When it comes to buying your new home, the insurance is just as important as the home itself.

There are a number of types of insurance you’ll need to consider: building or home insurance, contents insurance and mortgage protection insurance to name a few.

Building or home insurance

Depending on the type of loan you’ve taken out, it may be compulsory for you to take out building or home insurance to safeguard the lender’s interest in the property. Even if this is not mandatory, it is strongly advisable.

Building or home insurance covers you for damages to your property or its fixtures. Depending on your level of cover, you may be able to protect yourself for anything from fire and storm damage to burglary.

Essentially, home insurance covers the cost of restoring your property to its present condition if it is damaged. Make sure you read and understand the policy as insurance cover can vary from issuer to issuer. Also, don’t underestimate insurance costs, as you may end up out of pocket should disaster strike.

Contents insurance

Contents insurance protects you in the case of loss or damage to your personal belongings and items in your home, such as whitegoods, clothing and furniture. While you may already have contents insurance, it’s a good idea to update it after a move into a new property – especially if you’ve decked out your new house with brand new furniture and appliances.

You’ll usually have a choice between two types of contents insurance: a policy that replaces the old goods with new ones or you can opt for an indemnity policy, under which you’ll receive the depreciated value of what was damaged.

Mortgage protection insurance

Mortgage protection, while not mandatory for borrowers, can be an effective tool to help cover your mortgage should you find yourself unemployed, unable to work through injury or are diagnosed with a serious illness. Typically mortgage protection insurance covers the cost of your mortgage for the period of the claim, providing you time to re-enter the workforce or focus on regaining your health.

Speak with you broker if you’d like more information on any of these types of insurance – in many cases they can help arrange a policy for you.

Tips to finding the right insurance

- Take time to shop around: Compare the price of each policy with the cover offered – don’t go for a cheap deal with very little cover or pay top money for cover you don’t really need.

- Engage specialists: Speak with your broker for options on the insurances related to your new property purchase – they’ll be able to arrange the policies for you or alternatively refer you to a specialist.

- Keep documents secure: Remember to keep copies of your insurance policies, receipts and photographs away from the house, as they won’t be much help to you if they are damaged. Leave a set at your parents or a friend’s house, for example.

Dec 15

Is it possible to get ahead financially while still enjoying life?

Getting ahead financially doesn’t have to be a choice between living life to the fullest right now or being tied down in your own home with a huge mortgage.

Did you know you could possibly get your foot in the door of the investment property market without having to save for a huge deposit?

The taxman and your tenant’s rent can help you pay off your investment loan. You may only need to be a little more disciplined with your budget and finances and before you know it you could be sitting on a nice little investment property – a property that is making you money until you are ready to buy your dream home.

Have you heard the saying ‘making money while you sleep’? Well it could happen!

Nov 15

Property has been considered a popular path to wealth for Australians for many years. It has the potential to generate capital growth (an increase in the value of your asset) as well as rental income. There are also tax advantages associated with negative gearing. However, when buying an investment property, it is wise to remember that you are making a business decision and it’s worth taking the time to plan.